Wealth Management

We offer tailored, unbiased, institutional-quality solutions to preserve, protect and grow wealth

Our Approach

Navigating complexity with insights

Like Sherpas guiding mountaineers, we read the lay of the land by tapping on our deep expertise, diverse perspectives, and trusted partners to help clients navigate complexity and reach their long-term goals.

We holistically assess clients’ needs based on their current financial and personal situation alongside their wealth goals, as well as dynamic factors such as financial market conditions. We abide by a product-agnostic approach to deliver unbiased recommendations tailored to each client’s unique requirements.

Our Expertise

Tailoring solutions for unique needs

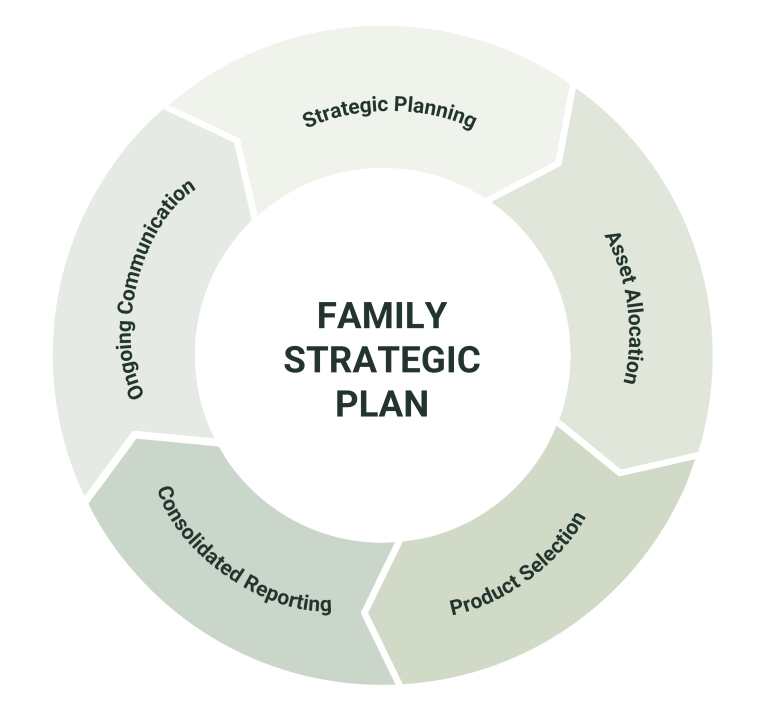

Strategic Planning

Asset Allocation

Product Selection

We identify best in class investment solutions across banks, asset managers, exchanges and direct investment opportunities that will deliver the best risk adjusted returns for your portfolio.

Consolidated Reporting

We provide a consolidated view of your assets, enabling optimised portfolio management and active risk response.

Ongoing Communication

We keep you informed on market developments, opportunities, and risks while incorporating your feedback and updates to support sound decisions.

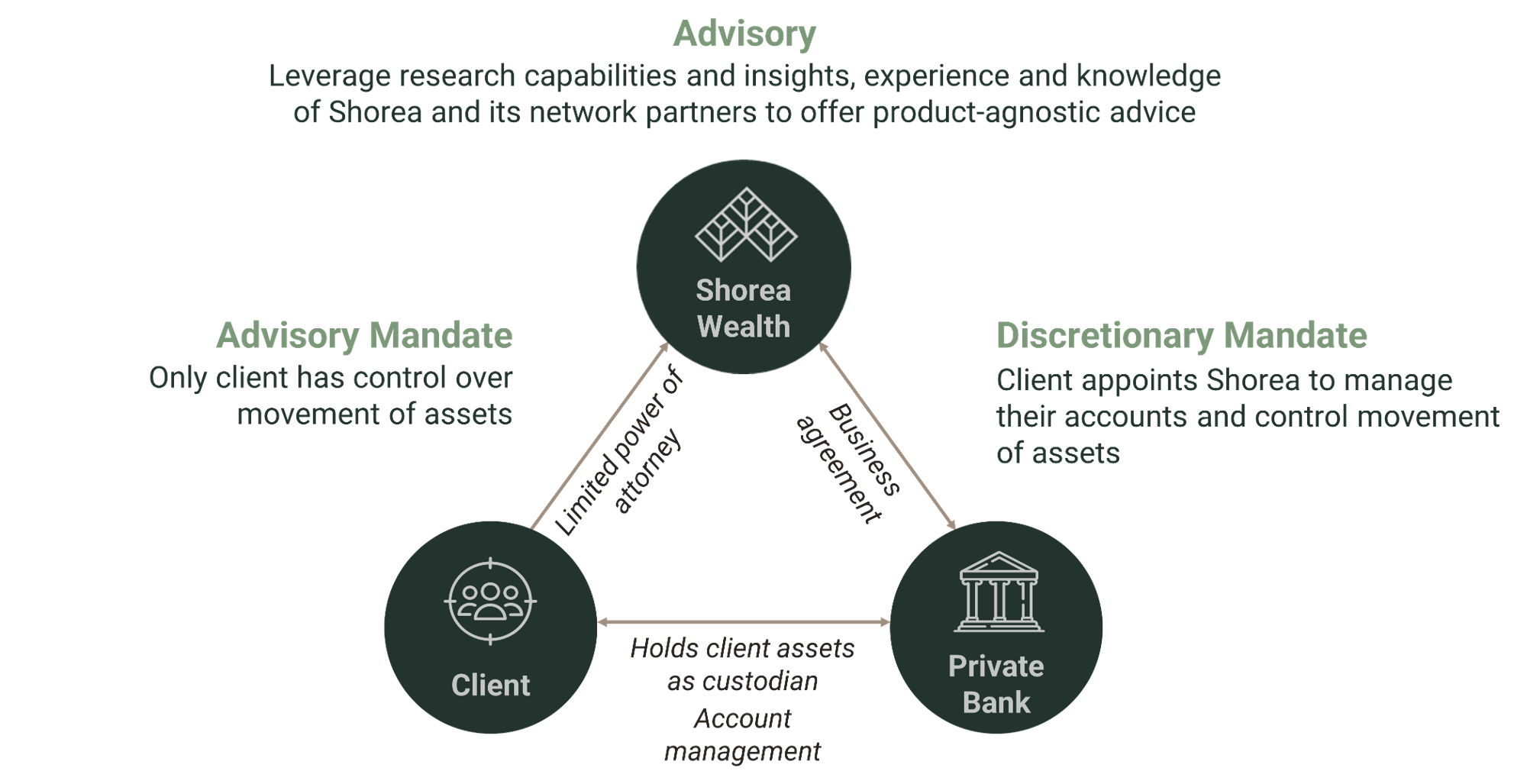

Discretionary

Mandate

Trust us with your investments and delegate decision-making to us through limited power of attorney

Advisory

Mandate

Draw on our full expertise and experience for timely updates or investment ideas and insights while you make the final decision

Consolidation and

Governance

Access Addepar for an aggregated view of your accounts across financial institutions

Our

Partners

Leverage research capabilities and insights, experience and knowledge of Shorea and its network partners for product-agnostic advice