Tailored Strategies

for Your Personalised Long-Term Growth

Our Firm

Trusted Partner, Investment Manager and Co-Investor

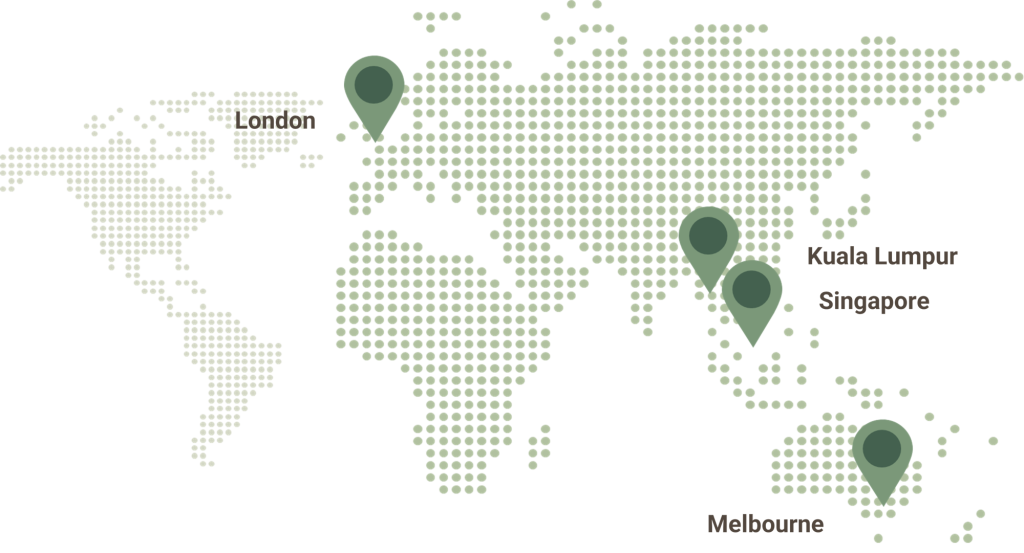

Shorea Capital is a Singapore-based professional investment management firm with over S$2 billion in assets under management. Our clients are family offices, UHNWIs and institutional investors in and outside Asia. We understand your needs and leverage our expertise to create bespoke solutions.

As a founder-led firm with a team of senior professionals who have an average of more than 25 years of experience in their respective fields, we uniquely combine institutional-grade real estate management with sophisticated wealth management solutions delivering holistic financial strategies. We serve as a trusted steward of capital while upholding high standards of governance and transparency.

Our sponsors include Hwa Hong Corporation, Newfields Group and Zen Capital. We bring institutional discipline and entrepreneurial agility to every portfolio we manage. Our subsidiary, Shorea Advisors Pte. Ltd. holds a Capital Markets Services license and is an Exempt Financial Advisor regulated by the Monetary Authority of Singapore.

Real Estate

Investment Management

Wealth Management

Our Investment Approach

Interest-aligned Partnership

We co-invest and align ourselves with our clients’ interests. Our business units do not operate in silos; we capitalise on the depth and breadth of experience, skill sets, and insights of our wider team to deliver synergistic value.

We have built a robust network of partners who are best in their expertise and share the same ethos of integrity and client centricity as we do.

Originate Bespoke Opportunities

We leverage our strong network and deep on-the-ground relationships to source far-off-market and on-market investments

Undertake Research and Due Diligence

We adopt a research-driven approach and harness our collective knowledge to evaluate each opportunity

Focus on Growth

We source and underwrite high-conviction opportunities that deliver outsized growth and risk-adjusted returns

Manage

Risks

We identify and measure potential risks and deliver advice specific to your needs

Our Partners

With an unwavering focus on building a robust network, our partners have been instrumental in empowering investors to navigate complexities, seize opportunities, and achieve unparalleled success.

Our Track Record

Proven execution across borders and asset classes

Anchored in Asia, we bring together a senior team and network of partners to help real estate asset owners, operators, managers, and fund managers to unlock opportunities across cycles and geographies.

Since 2018, we have executed real estate transactions worth over S$2 billion across Singapore, Australia and the UK