Real Estate

We integrate real estate investment & development skills with research & capital and financial markets expertise to deliver tailored & impactful investment solutions

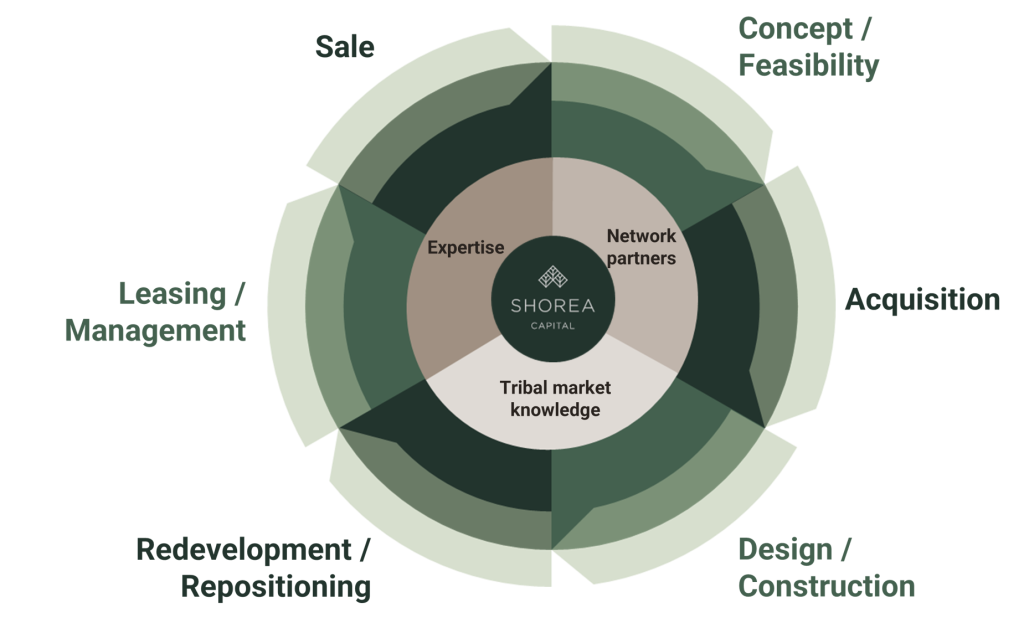

Our Approach

Collaboration drives institutional strength

With dedicated teams across Singapore, Australia, and the UK, we provide exceptional local market expertise and comprehensive understanding of regulatory landscapes and business dynamics. Our collaborative approach combines institutional knowledge and proven insights from our extensive network to develop customised investment strategies that optimise returns and deliver on your objectives.

Our Expertise

Guiding growth through expert stewardship

Investment Strategy & Advisory

We develop tailored investment strategies that align with clients’ objectives, market cycles, and sector trends, ensuring long-term portfolio resilience.

Read More

Development & Asset Management

We manage developments from concept to completion, delivering high-quality projects on schedule and within budget. We focus on strategic leasing, operational efficiency, capex planning to optimise returns.

Read More

Capital Structuring & Fund Raising

We leverage our network to create efficient capital structures and help clients raise capital for acquisitions and development.

Read More

Listed Equities and Special Situations

We apply our expertise in managing real estate listed equities and special situations to deliver consistent returns.

Read More